Let’s take a break - 5 days + 1 review

Published: July 22, 2021

“Let’s take a break - 5 days + 1 review ”

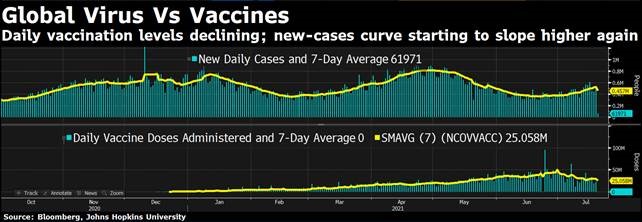

Last week was slightly positive for the EUR high yield while the other risky asset classes anticipated a quite risk off Monday. Is the volatility in the market just related to the rising in the new cases? Or there is something more? Investors, which during 2020 discounted a quick recovery, now looks like the person in a relationship asking for the classical break - some time to reflect.

Central banks, who in this story represent the mutual conciliating friend, seem to have convinced, in the last weeks, most of the market segments that inflation is temporary.

Long duration asset classes performed well in the last week signalling 3 possible scenarios:

- It’s just a break – This is the best scenario which represents a pause of reflection from the rally due to the new cases.

- Back after short separation – Inflation won’t last and it s just temporary, representing a comeback to the pre covid old normal world.

- Divorce – This is the worst scenario, where IG rally is related to the economic disappointing data - like real retail sales down 0.4% in June after a 2.4% slide in May and auto and home buying plans hit 4 decade lows in July - anticipating a recession environment.