March 15 Eow Review - Flirting with higher yields

Published: March 15, 2021

“Flirting with higher yields”

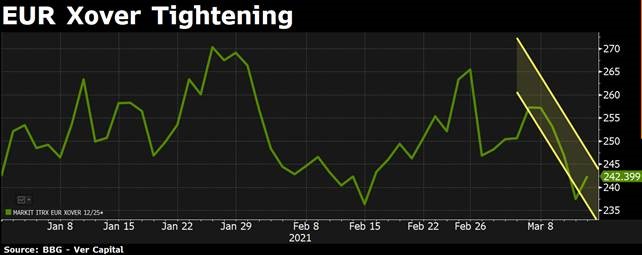

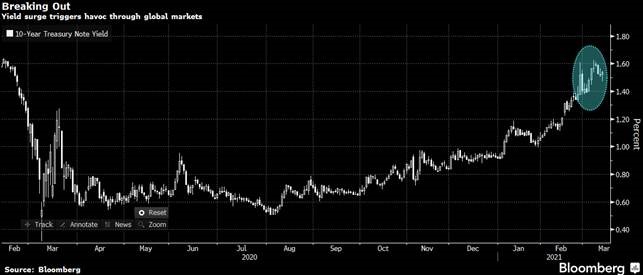

Positive week for the market and the Eur High Yield segment posting an encouraging +20 bps. The rotation towards value at least this week stopped. Even if the continuous recovery of US inflation expectations, with the US 10y breakeven reaching new post-pandemic highs, the market flirted with risky assets. It seems counterintuitive but there are a couple of explanations out there.

First the confirmation of the 1.9 trillion of stimulus boosted investors’ confidence, then US core inflation in February climbed less than expected making thinking investors that, maybe, inflation is more down the road than soon.

And finally ECB decision which can be summarized as follows: “purchases under the PEPP over the next quarter [are expected] to be conducted at a significantly higher pace than during the first months of this year” pushed the market rally with a tightening of the spreads by the classic mantra of TINA (there is no alternative)