March 01 EoW Review - Yield curve steepening

Published: March 1, 2021

Yield curve steepening

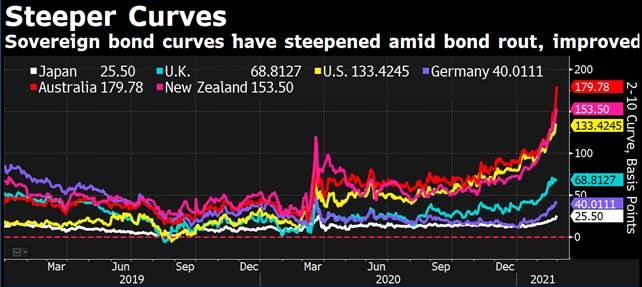

Negative week for the market and the Eur High Yield segment posting -39 bps of which -20 bps only on Friday. Market performances are directly linked to the steepening of the yield curves around the world. If inflation expectations continue to rise most of the asset classes will be subject to a reprice and portfolio managers around the globe will be focused on value, commodities, inflation linked assets and short term part of the credit curve (especially if central banks will be net buyers for the whole 2021).

Even if J. Powell confirmed monetary policy will be untouched for a while, markets participants are interpreting fiscal support and the discussion on the minimum wage as future inflation pressures. Benchmark 10-year Treasury yields are at the highest in more than a year at over 1.6%.

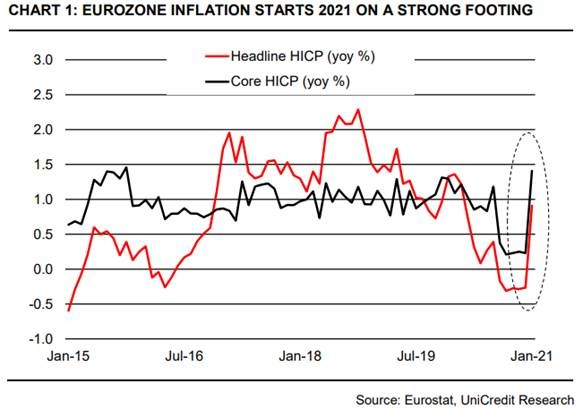

In Europe, however, the story looks a bit different especially if we focus on the actual data. Inflation in January jumped to 0.9% yoy from -0.3% it driven by a strong rise in core prices. As Unicredit analysis pointed out this looks more related to 3 temporary factors than a trend. In fact, in the increase in headline and core inflation seems driven by

- the reversal of the German VAT cut that took place in 2020;

- a “basket effect”, during the current year there were unprecedentedly large changes, reflecting the new composition of private consumption given the restrictions to contain the spread of COVID-19;

- a delay of seasonal sales. The Covid restrictions imposed in December shifted part of the retail purchases to January 2021.

Going back to the HY segment we underline a couple of interesting points related to the turnover trades are:

- the worst sectors in terms of performances were other utility, energy and insurance names

- the best ones were Natural gas and Real estate’s names.

This seems to contradict the turnover trade we discussed above. We should see an improvement in inflation linked sectors like natural gas real estate and energy. However, Energy was one of the worst performing because, its basket, as the insurance one, is composed by many perpetuals names that are highly affected by the potential inflation movements. In fact this is furtherly confirmed by the duration performances represented below