Loans Update - June 14

Published: June 14, 2021

EOW Loans Update – It’s raining green

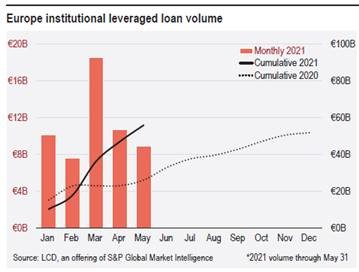

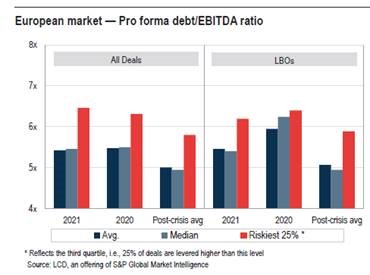

European Leveraged Loan Index (ELLI) has registered a slightly positive week, bringing returns to +0.19% (+0.19% excluding currency effect) in June and +3.12% (+2.88% excluding currency effect) year to date. In comparison with the previous year, the pipeline has been hitting the primary with lower leverages in the LBO deals but fairly aligned with 2020 when accounting all the deals instead.

Distant may be the days where discussions regarding ESG started, but for the leveraged loan market, it seems that the action hit the gas strongly in 2021. The trend of sustainability-linked issuance has been attracting the attention of the markets with multiple market participants producing reports on this thematic. S&P Global Ratings published that Green Issues remain prolific across both the European high-yield and leveraged loan primary markets in the beginning of June, and suggests that sustainability-linked bonds globally may account for $50 billion of issuance in 2021.

On a documentation level the leveraged loan market has been hastily evolving. The first deals that had any documents ESG related to reach our desk in 2021 had simply one page of commentary on the matter. Nonetheless, the impact of ESG has not been only on the legal/informative side. As observed by ING, there is also the yield component. On the spread side of the yield, deals as Flender, Stark, Elsan and Mehilainen had margin ratchets that would unlock a decrease in spread if certain ESG KPIs would be observed, but could also increase the spread if the business were to worsen its ESG aspects. So far, the ESG margin ratches have been usually from the range of +10 bps to +5bps in case of worsening kpis and -10 bps to -5 bps in case of improving kpis.

In conclusion, both lenders and borrowers are investing funds and energy in ESG, which should not be seeing as a trend anymore but as a new normal on the European Leveraged Loan market.