august 28 - last week HY

Published: Aug. 28, 2020

Another summer quiet positive week on the High Yield credit space with the index posting a return close to 30 bps. With some exceptions, cash generally trended upwards and Xover tightened in the 320 bps area. On Thursday Powell outlined a new approach for the US monetary policy.

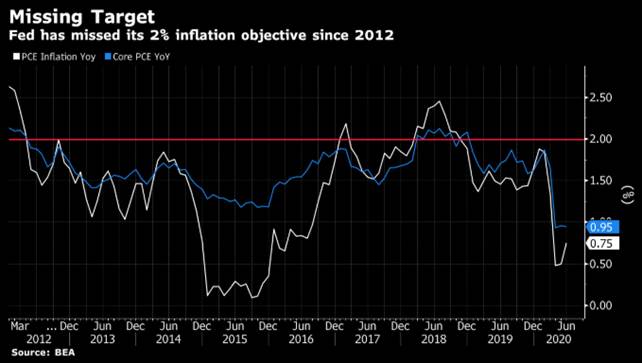

The Fed will no longer have a 2 % inflation target, which has been consistently unreachable since the financial crisis, but rather an average inflation target of 2% that serves to “make up” for previous bouts of low inflation. The treasury yield curve steepened after Powell confirmed the FED will stay accommodative even if inflation would trend higher in the short term. During the last weeks many HY companies reported half year financials better than expected. Even if most of the companies posted historical credit metrics’ erosions their underlying bond prices drifted higher mostly because of the central banks liquidity injection and investors’ expectations on the quick rebound of the economy.