EOW Loans Update - February 26

Published: Feb. 26, 2021

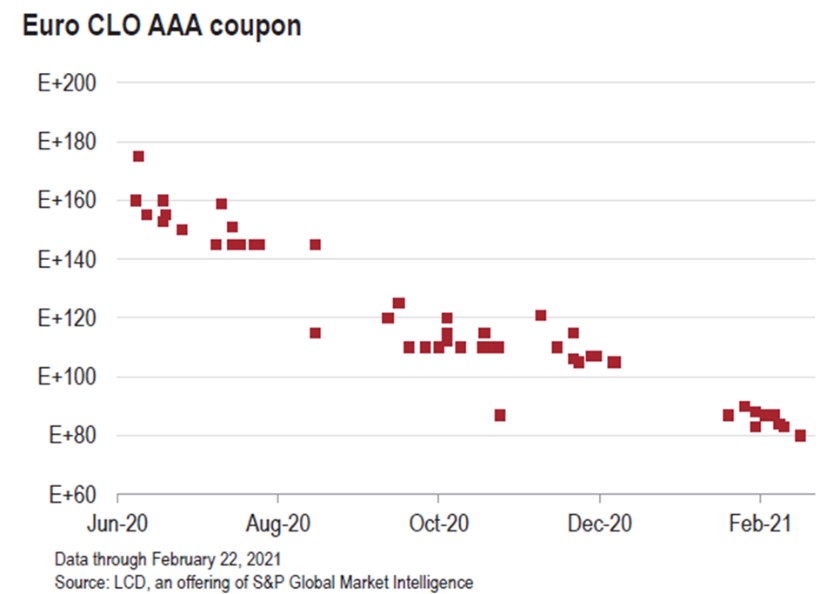

The positive performance of the European loan market is continuing also in February and the YTD performance of the ELLI is close to +2%. Yields in the loan market are trending down, driven by accommodative monetary policies and supported by a lower cost of CLO liabilities.

Market is healthy, supported by both repricings, such as the recently closed transactions of Zentiva and Biogroup and by new buyouts such as the acquisitions of Stark Group and Flender. New loan issuance volume is behind previous year, with €18 billion vs €25 billion in 2020, but is expected to surge in the coming months supported by an already anticipated pipeline above €7 billion.

Looking at the recently launched loans, many are already including margin ratchets linked to environmental, social, and governance (ESG) criteria (e.g. Ahlsell and Elsan). On the one hand, this is an important step toward a more sustainable market and is supported by both private equity sponsors, credit funds and institutional investors. On the other hand, in a market with yields near to historical low levels, margin ratchets linked to ESG criteria could be challenging for CLOs.