september 25 - last week HY

Published: Sept. 25, 2020

Rough week in the markets with the HY index posting a negative performance close to -1.33%, after weeks of resistance with respect to equity shortfalls. The week was characterized by bearish sessions on the back of climbing virus and leaked Financial Crimes Enforcement Network documents about suspicious transactions by global banks such as JPM, DB or HSBC. Even if retail sales are recovering, consumer confidence is failing to bounce back rapidly. PMI data are suggesting a slowdown for the main European countries but Germany which is outpacing, as usual, its peers.

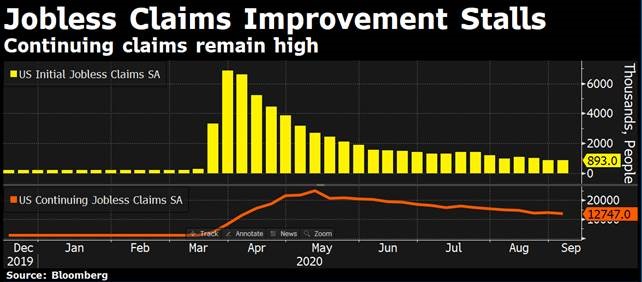

Beyond the news related to the stall in the US the employment, there has not been any “new bad news”. It is all about sentiment. The increasing signs of widespread 2nd waves hurts sentiment, not helped by one of the most uncertain presidential election in the American history.

It’s seems the recovery coming from the expansionary policy has lost its strength and the markets need other liquidity injections. ECB economist take the inflation shortfall quite seriously and suggest the need for new expansionary measures