october 02 - last week HY

Published: Oct. 5, 2020

A way calmer week in the HY segment compared to the previous one with the index posting a positive performance close to +62bps. Labour markets data were better than expected: August unemployment decreased in Germany, despite less intense use of subsidies and in Italy despite the removal of the firing ban. European inflation data continue to confirm something we already know: a deflationary environment.

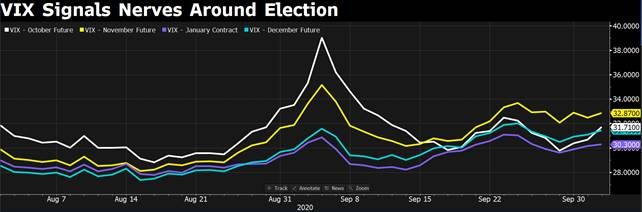

Slightly different the US markets characterized by higher volatility and uncertainties related to the US elections. Implied volatility shown below is here to stay further confirmed by the news regarding Trump’s positivity to Covid-19.

Dispersion between Covid-impacted names and those perceived to be more resilient is rising and unsurprisingly after last week market activity is slowing down. This is due to

- The last week comeback volatility; and

- The market has already posted 117 deals for €57.3 billion, versus 100 deals for €47.3 billion in 2019 since the beginning of the year.

We think the dynamic of technicals on the supply side is clear until the end of the year, where issuers take quickly advantage of quieter weeks testing the markets’ conditions.