april 19 review - Déjà vu

Published: April 19, 2021

“Déjà vu ”

USD and EUR HY spreads are closing on their historical tights despite a backdrop of extremely elevated supply. Markets, nowadays, look like a déjà vu : something we feel have already experienced. In the award winning movie the Matrix the concept is explained by the dialogue:

Neo : What is it? Trinity : A déjà vu is usually a glitch in the Matrix. It happens when they change something.

The market, in fact, is characterized by the same features pre Covid 19:

- Tons of liquidity by central banks

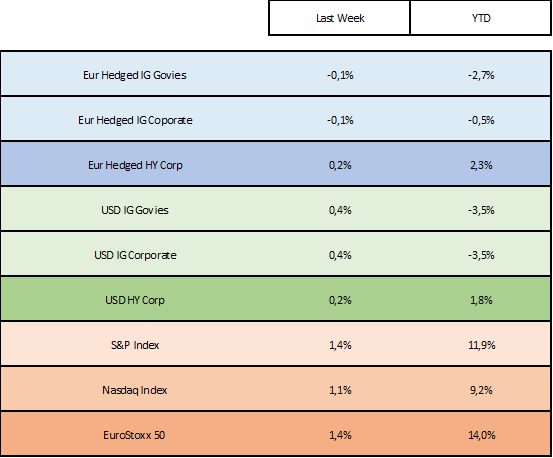

- Equity at the highest levels

- Tight spreads

- Decline in the Index-level implied volatility the last months.

The “glitch” could be represented by higher interest rates, but, so far, it is a quite handsome déjà vu reinforced by last week positive macro data and dovish stance that have continued to move risky assets higher anchoring implied volatility and supporting appetite for carry.