december 7 - last week HY

Published: Dec. 7, 2020

Another positive week on the Eur High Yield segment with the index posting return other +63bps after the 70 bps of the previous one. The general constructive mood in European credit markets continued with markets supported by strong technical factors (ECB). Against the backdrop of COVID-19 vaccine news, HY credit markets rallied in November with HY bonds having their best monthly performance since April.

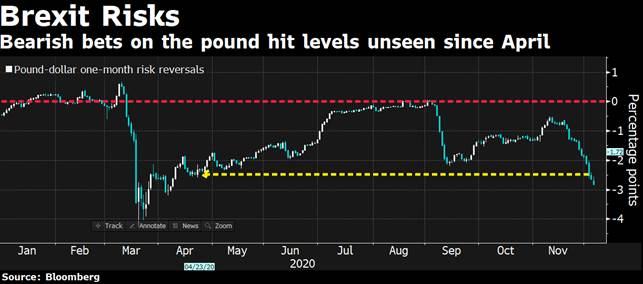

Market players’ euphoria is condensed within the strong back bid for rotation towards cyclical assets. Liquidity in the market is reinsuring investors and any potential bad news is discarded or a potential “buy the dip” moment. In the last week UK ministers are have clearly said “Brexit trade talks are in a very difficult place”. A piece of news completely ignored by the markets with the exception of the FX segment represented below.

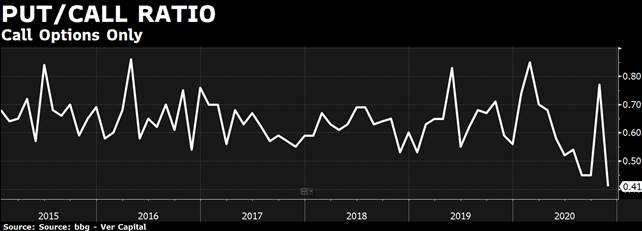

The exuberance, represented by the graph below, can be explained only partially by the promises of new fiscal stimulus from both FED and ECB central banks. On Thursday, the ECB will announce its second-round COVID response. PEPP will be boosted by EUR 500bn (on top of the EUR 600-650bn still in the tank from the first round) to be applied through at least the end of next year, possibly until mid-2022.

Meanwhile, November was a clear risk-on month where lower-rated bonds were the clear winners. CCC (+7.5%) and single B rated bonds (+5.6%) BBs (+3.5%). Technicals were supportive because new supply of rated HY bonds slowed down in November (EUR 6.2bn) after a record October (EUR 17bn). Technicals could remain strong in the HY market with limited supply in December given the small window of opportunity left until the Christmas.