November 23 - last week HY

Published: Nov. 23, 2020

Positive week for the Eur HY markets posting a return close to +0.65%. A way calmer week than the last ones straightened by the announcement of a super effective vaccine by Moderna. Vaccine optimism and apparent unbreakable technicals continue to underpin market strength. As a result risk aversion is disappearing in the market.

On the Brexit front, if anyone might care, U.K. and European Union could strike a deal on their future trading and security relationship early next week as the two sides edge closer to agreement on the biggest sticking points. Even if performances in the last weeks have been surprisingly strong, risk sentiment remains anyway fragile as markets are and will oscillating between the positive developments on vaccines and the increasing number of Covid-19 cases.

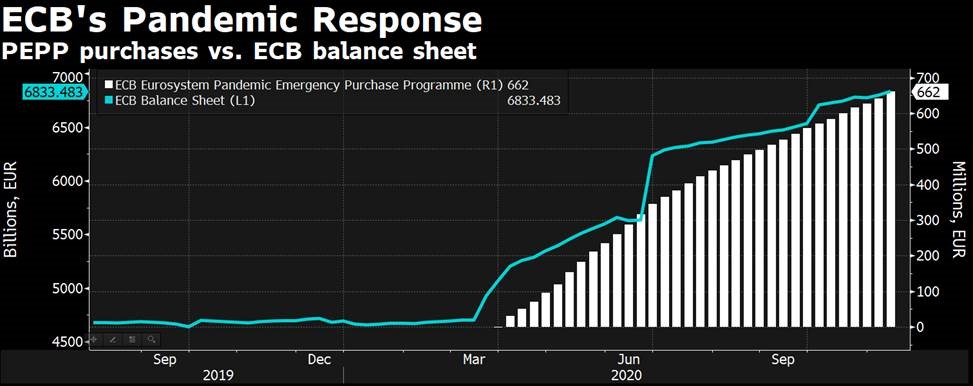

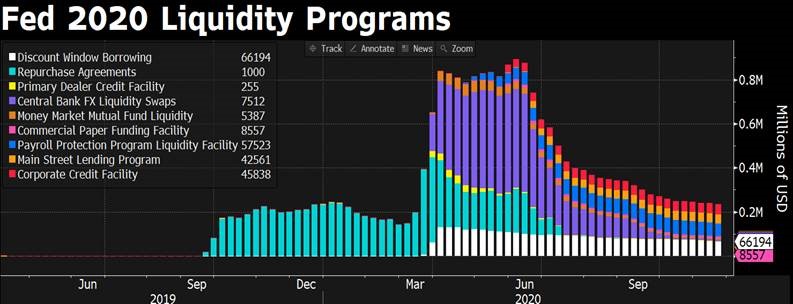

There were no big news coming from the world central banks this week except the disappointment of the FED regarding the decision of the US Treasury to not extend some emergency loan programs. The statement of the FED: “The Federal Reserve would prefer that the full suite of emergency facilities established during the coronavirus pandemic continue to serve their important role as a backstop for our still-strained and vulnerable economy” seems to declare that liquidity programs represented below are here to stay for a bit longer than expected. The same thing can be said of ECB’s strategy.