2021 1st quarter: Frank Ghery vs Lloyd Wright

Published: April 6, 2021

The first quarter ended with a clear signal for fixed income financial players: it is all about convexity! Architecture works with convexity, curves and lines. Frank Ghery is probably the most famous architect using almost impossible round curves (like the picture below). The other Frank, Lloyd Wright’s most famous work is the more rigorous “Fallingwater”.

In financial markets if duration is the first derivative, convexity is the second one and it represents the speed of the price going up or down. Higher the convexity, the more dramatic the change in price given a move in interest rates. Factors affecting a high convexity are:

- Longer maturity

- Low coupons

- Low Yield

All of these factors can be inherently found in the both IG corporate and govies bonds. Both segments display huge convexities and their investors are “sat” on F. Ghery building with dramatic change of prices. Investors are learning the hard what convexity really means. The BBG aggregate index (IG both corporate e govies) lost 3.37% in the first quarter marking the worst index return since 1983.

High Yield investors, on the convexity perspective, are “sat” on more rigorous F. Lloyd building with far less convexity given lower structural duration, higher yields and coupons.

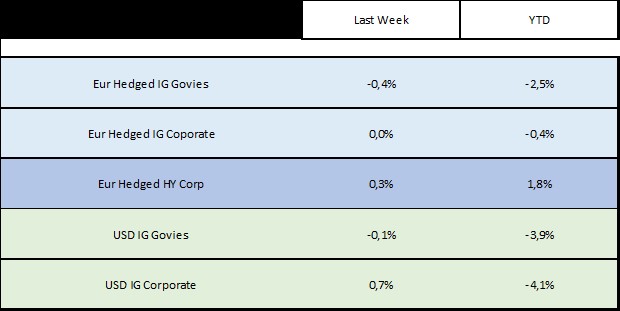

We don’t want any “Casabella” magazine readers to complain with us, so we are going to stop here with architecture comparisons and we’ll finish this post with an old-style table that summarize with numbers concept and performances of the first quarter of 2021.