november 09 - last week HY

Published: Nov. 9, 2020

What a week! The only driver in the market this week was the US election. Trump, Biden, Blue wave, frauds’ accusations and everything you wished if you wanted to be entertained. Markets rallied amid spikes of volatility. The High Yield segment is no exception posting a positive return of more than + 1,5%.

Bottom line, Biden won and Trump legal challenges appear weak. It seems the market can focus at one thing at the time. Increasing Covid cases and restriction are still out there but they were overlooked last week by financial players, especially in US which become the first country to top 100 000 cases in one day. Anyway, thinking about what is next for the US, Biden’s agenda looks like to have the following steps set:

- a fiscal recovery plan,

- a recommitment to multilateralism to deal with international politics,

- policies to address the racial tensions (including healthcare allowances),

- climate change, including bringing the US back to the Paris Afford.

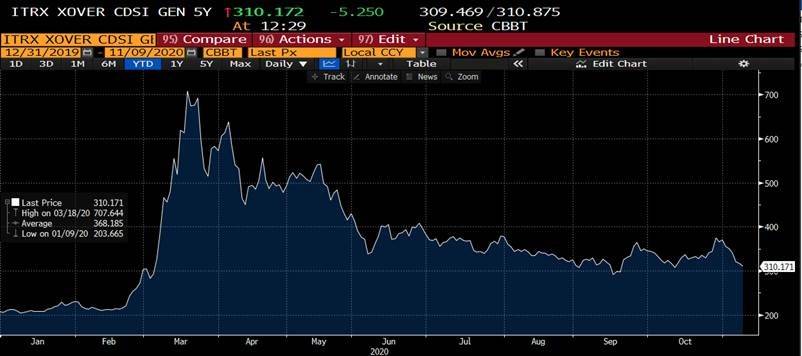

As the Vix, represented by the graph above, was somehow forecasting the euro synthetic index of the HY market tightened in a week by more than 50 bps showing how much quickly the market passes from risk off to a risk on context.

During the week even the best friend of the markets FED chair J. Powell did not catch the attention. He stressed that the economy needs more fiscal and monetary policy support, given the coronavirus infection rates: “I think we’ll have a stronger recovery if we can just get at least some more fiscal support”.