Overview

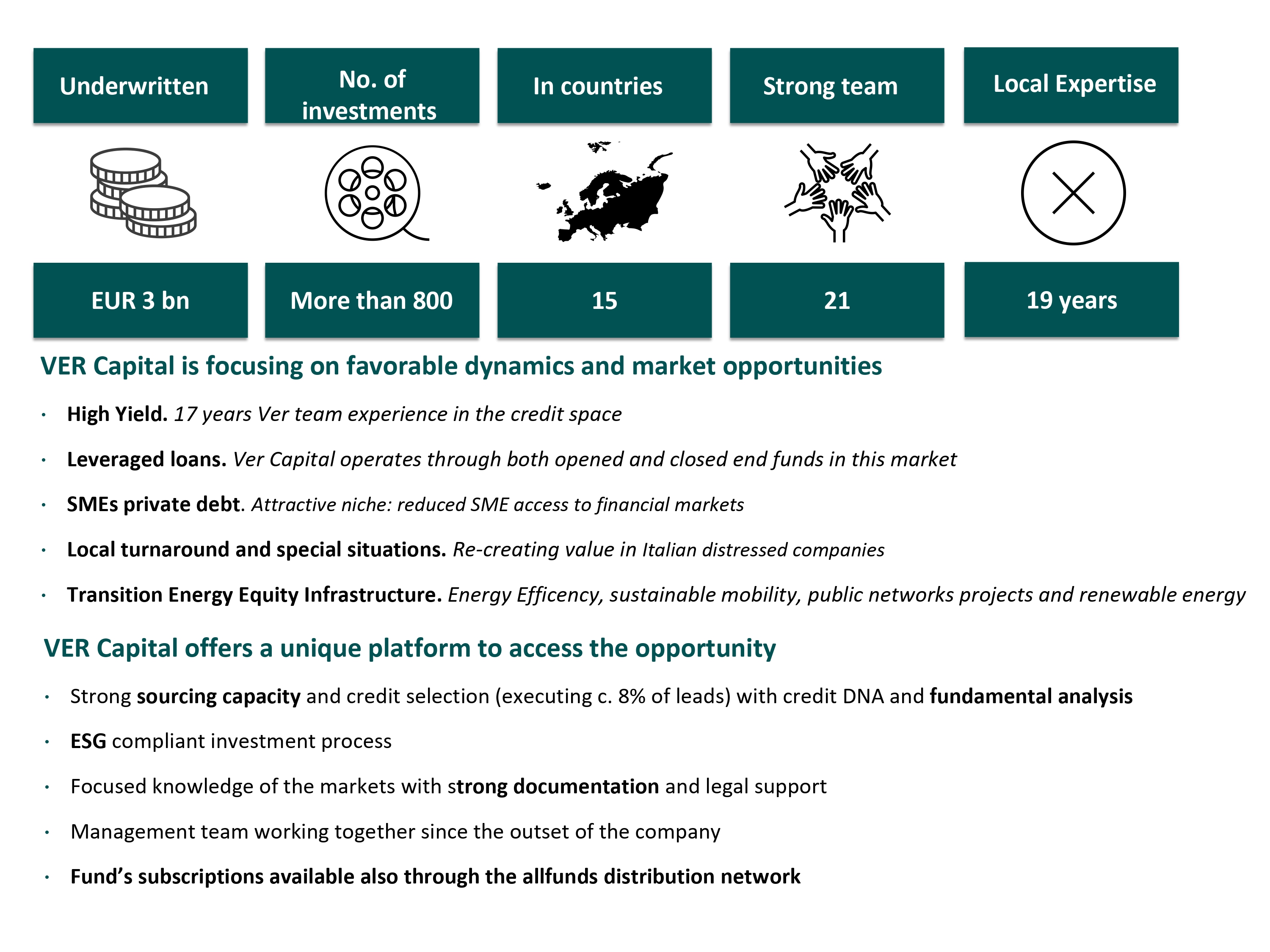

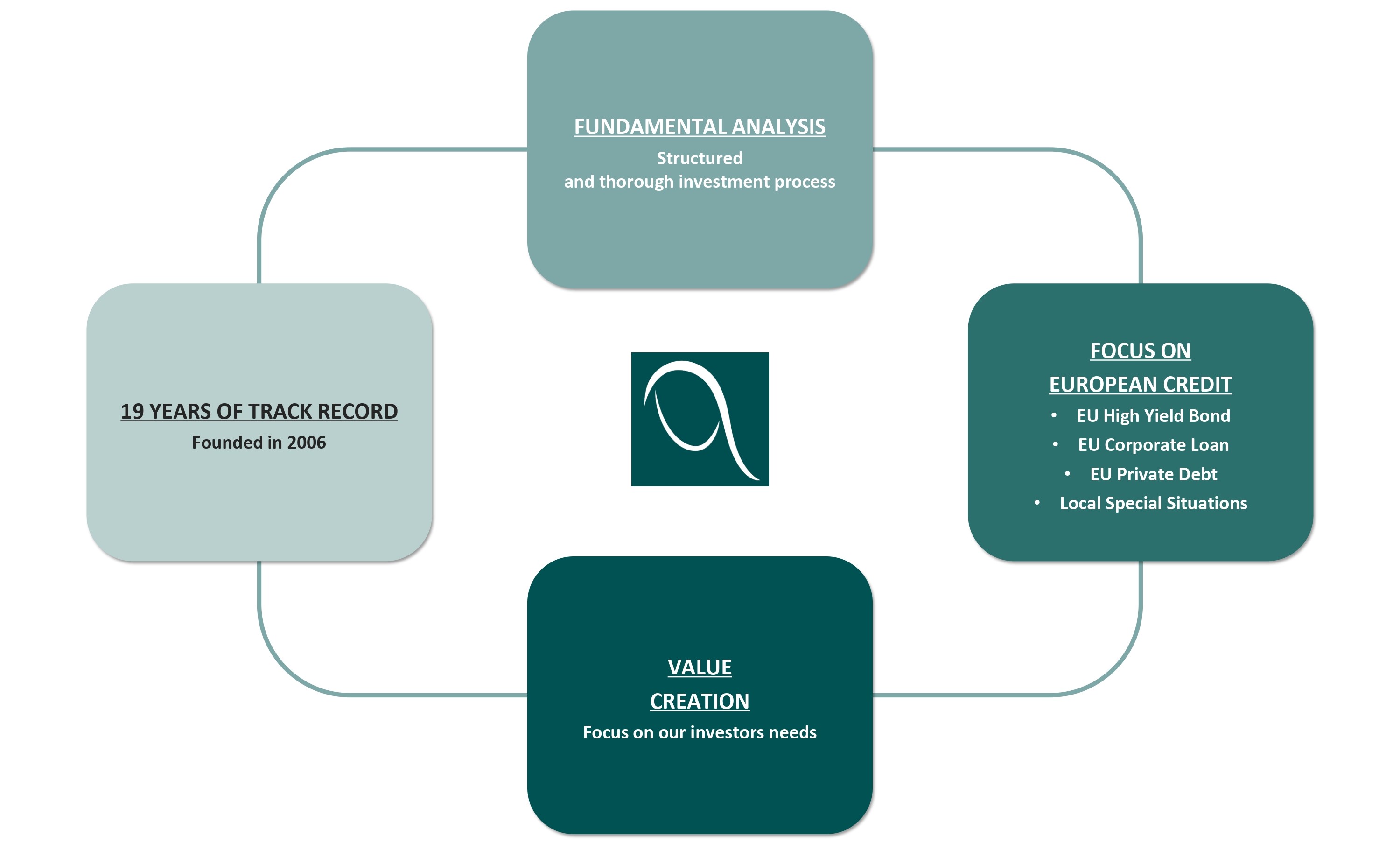

Ver Capital Sgr is an independent asset management company focused on European corporate credit and operating across five main verticals: Euro High Yield, Euro Loans, Private Debt, Special Situations, and Energy Transition.

Senior management has been working together since 2006 and combines considerable experience in liquid credit products (high-yield and corporate loans) and illiquid strategies (private debt, special situation and infra-equity).

The long track record, achieved over several economic cycles since the global financial crisis of 2008, combined with an approach to investing based on fundamental analysis, is a distinguishing feature, strengthened by an entirely in-house team of analysts.

The client base is institutional and is composed by: insurance companies, pension funds, pension funds, foundations, banks, family offices, and funds of funds.

The firm is a PRIs signatory incorporating ESG factors into investment decisions and it launched one of the first ART 9 SFDR fund.

OUR MISSION

Our mission is to provide tailored credit solutions in companies across Europe, while offering our investors superior risk adjusted return, with strong downside protection, transparency, and strictly followed ESG guidelines.

OUR BUSINESS MODEL

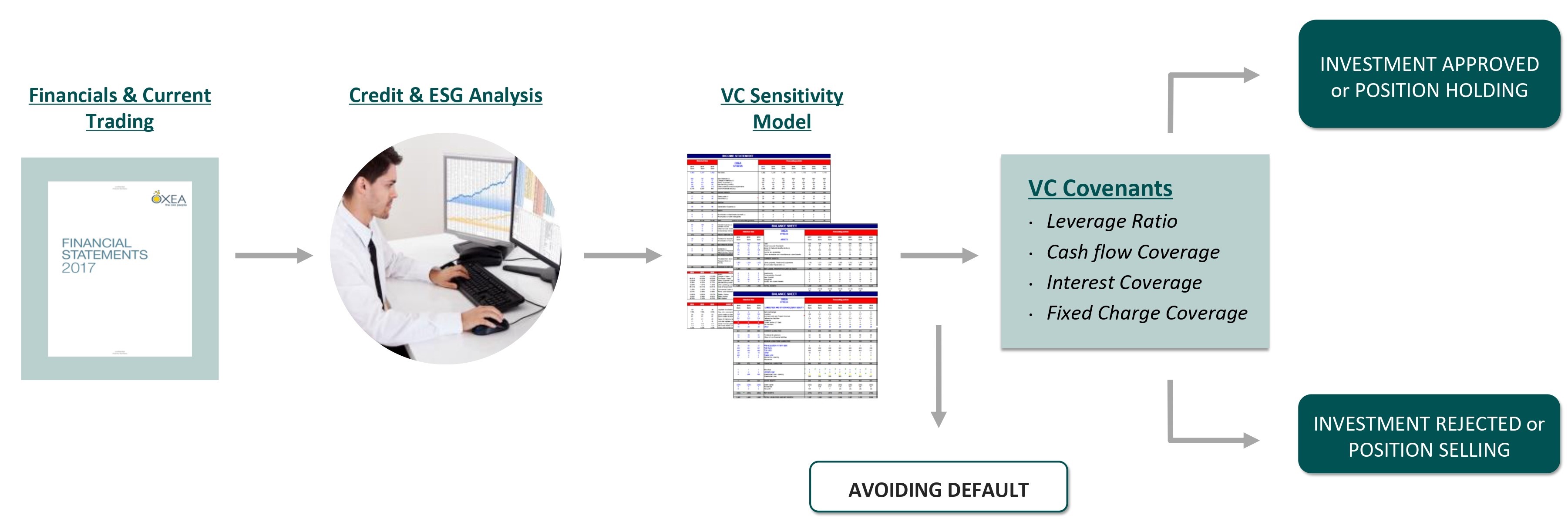

Deep fundamental analysis. Ver Capital has developed a proprietary investment analysis / evaluation model tested in different market contexts and on different types of companies.

REPORTING

Ver Capital built a very comprehensive Quarterly and Monthly Reporting, which is sent to all investors.

The reporting describes minutely the quarterly and monthly performances of the funds; moreover it gives an update on the loan and bond market conditions and includes the updated performance of each portfolio.

In addition to the above, Ver Capital provides insurance companies and banks with all the information they need to calculate the SCR in accordance with Solvency II rules or for their internal models (TPT reporting).

The depositary bank provides investors the official NAV of the funds.

On annual basis, the depositary bank provides financial statements of the funds.